This is part of a special series based on the April 2024 edition of the Commodity Markets Outlook, a flagship report published by the World Bank. This series features concise summaries of commodity-specific sections extracted from the report.

This is part of a special series based on the April 2024 edition of the Commodity Markets Outlook, a flagship report published by the World Bank. This series features concise summaries of commodity-specific sections extracted from the report.

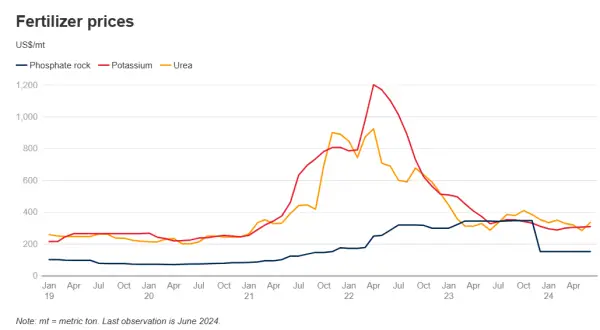

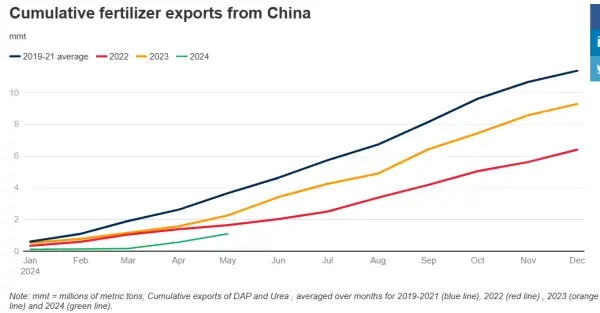

The World Bank’s fertilizer price index remained relatively stable during the second quarter of 2024, following a 20 percent drop in the first quarter. The index is 24 percent lower than it was a year ago, primarily due to a significant decline in phosphate rock prices (-56 percent) and potassium prices (-17 percent). This broad weakness is attributed to improved production prospects driven, for the most part, by lower input costs. In the second quarter of 2024, the fertilizer affordability index (the ratio of fertilizer prices to food prices) reached its 2015-19 average level. Compared to 2023, prices are expected to average lower in 2024 and 2025 but remain well above 2015-19 levels due to robust demand and some export restrictions (particularly from China) and sanctions (mainly Belarus). Upside risks to the forecast include potential increases in input costs, especially natural gas. However, a resumption of China’s exports and lower-than-expected crop prices could contribute to further declines in fertilizer prices.

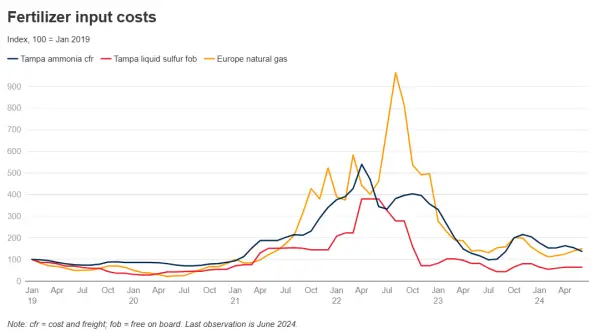

Although fertilizer input costs have dropped significantly from their 2022-23 peaks, they remain higher than pre-2020 levels. Key inputs for fertilizer production, which saw substantial price declines from their 2022-23 records, have shown some stability in the past two quarters. For instance, natural gas prices in Europe rose by almost 15 percent in 2024Q2 (q/q) but are still 11 percent lower than a year ago. Natural gas is the most critical cost component for nitrogen-based fertilizers. Similarly, sulfur prices are around 26 percent lower than a year ago. However, over the past four quarters, the average prices of these three inputs have been more than 30 percent higher than their 2015-19 averages.

Export restrictions and sanctions continue to play a significant role in fertilizer markets, but trade diversions have largely mitigated their impact. While exports of phosphate from China and ammonia from Russia have impacted global trade flows, Europe has substituted imports from China and Russia with those from other exporters, including Egypt (ammonia), Morocco (phosphate), Saudi Arabia, and the United States. On the potassium side, despite sanctions imposed on Belarus and Russia—which together account for nearly half of global potassium output—exports from both countries have been stronger than expected due to trade diversion. Belarus has increased exports to China, with Russia expanding rail capacity to facilitate Belarus’ shipments. Meanwhile, exports from Canada have been diverted to Europe.

Fertilizer affordability has returned to its pre-2019 average. Lower fertilizer prices during the past few quarters have brought the fertilizer affordability index (the ratio of fertilizer prices to food prices) close to 2015-19 levels. During the fertilizer price spike of 2022, the affordability index nearly doubled compared to its long-term average.